3 min read

Commonwealth Bank's Audit-Ready Operations: Strengthening Compliance with Governance Solution

.jpg) Ale Sanchez

:

Jan 31, 2026 4:10:55 PM

Ale Sanchez

:

Jan 31, 2026 4:10:55 PM

In their own words

.jpg?width=2000&name=Capa%201%201%20(1).jpg)

Commonwealth Bank Risk Management Team

Assessing entity risk was complex and manual, exposing the organization to potential regulatory fines and financial liability.

We built an AI-driven solution (PoC) to assess key risk factors, automating and streamlining compliance reporting.

The bank gained streamlined compliance and efficient risk assessment, helping to protect Cash Flow (CFO) and minimize regulatory exposure.

Immediate

Risk Factor Consolidation

Comprehensive

Risk Reporting Output

AI-Powered

Risk Assessment Engine

Streamlined

Compliance Efficiency

The Challenge:

Manual Entity Risk Assessments Threaten Audit-Readiness and Compliance

The Commonwealth Bank faced a critical operational challenge driven by the complexity and manual nature of its entity risk assessment process. Existing methods demanded extensive consolidation of disparate data sources and manual report generation across multiple legal entities and jurisdictions. This slow, resource-intensive workflow not only diverted risk teams from higher-value analysis, it also introduced significant exposure to human error, delays, and inconsistency—heightening the likelihood of regulatory penalties and financial impact in an already stringent banking environment. The bank needed a step-change in its approach to achieve truly audit-ready operations, streamlined compliance, and a more proactive, resilient posture toward financial risk.

The Approach:

Our Disciplined Partnership for Financial Security

In a sector where trust is paramount, the implementation style was built around deep domain expertise and a security-first commitment. We didn't approach this as a generic AI project; we partnered with the Commonwealth Bank risk teams, ensuring every decision was governed by the necessity of protecting financial operations and meeting stringent banking regulations. This approach allowed us to simplify complexity while ensuring the final solution was reliable, secure, and auditable.

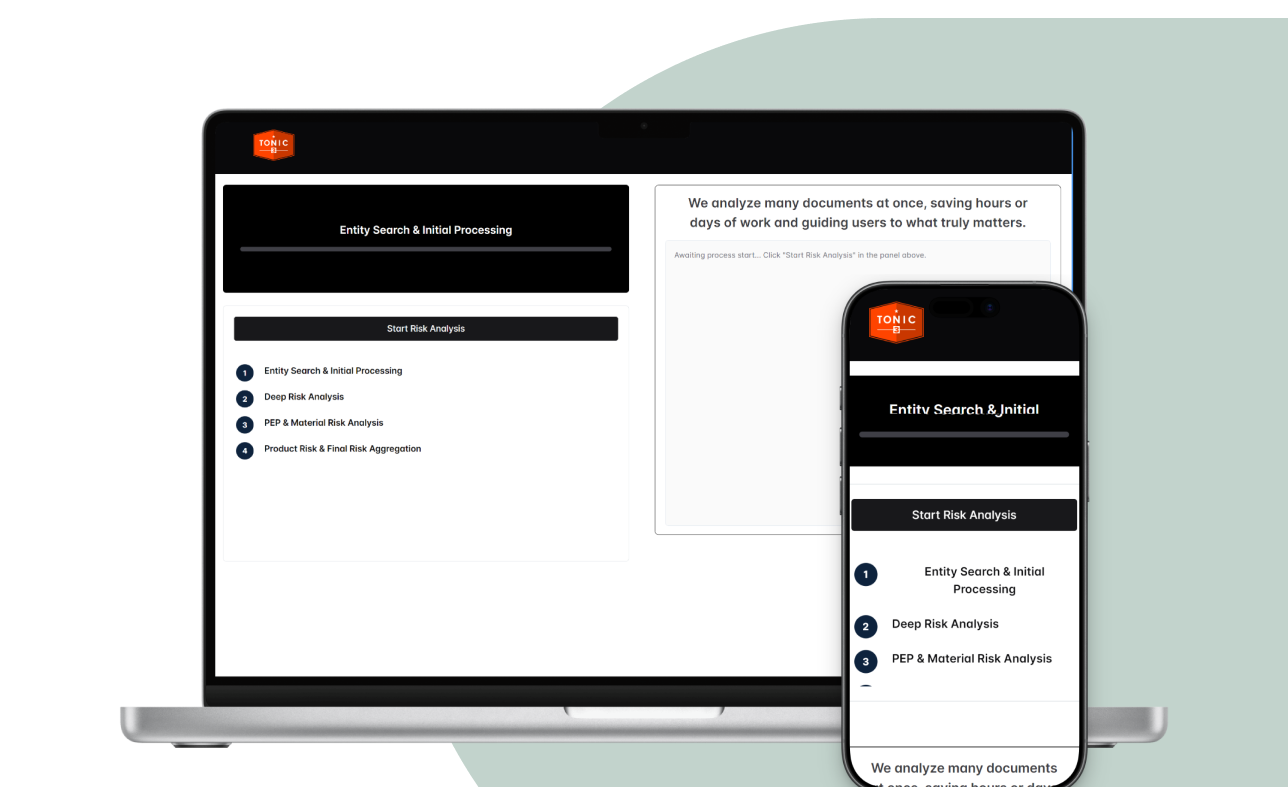

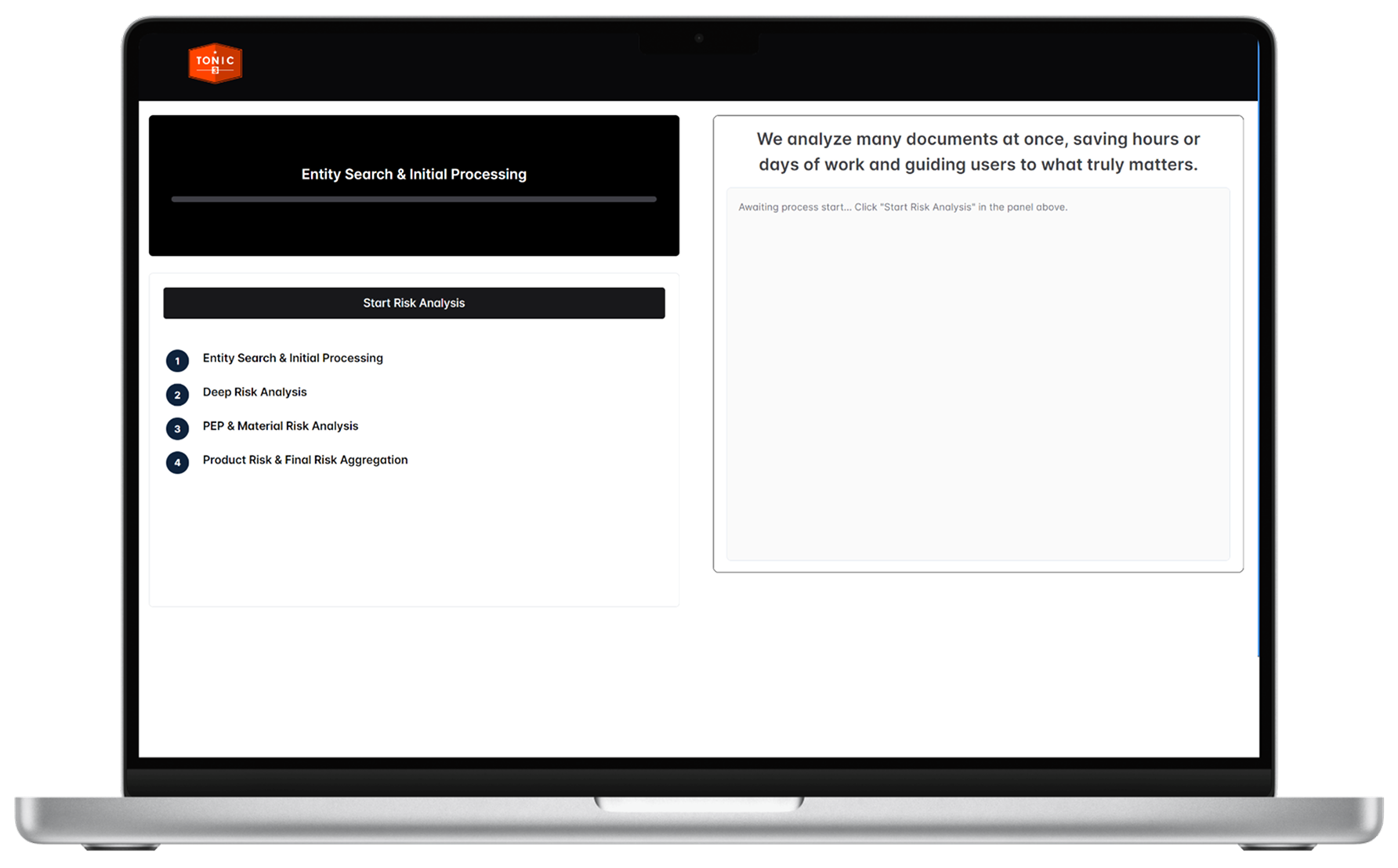

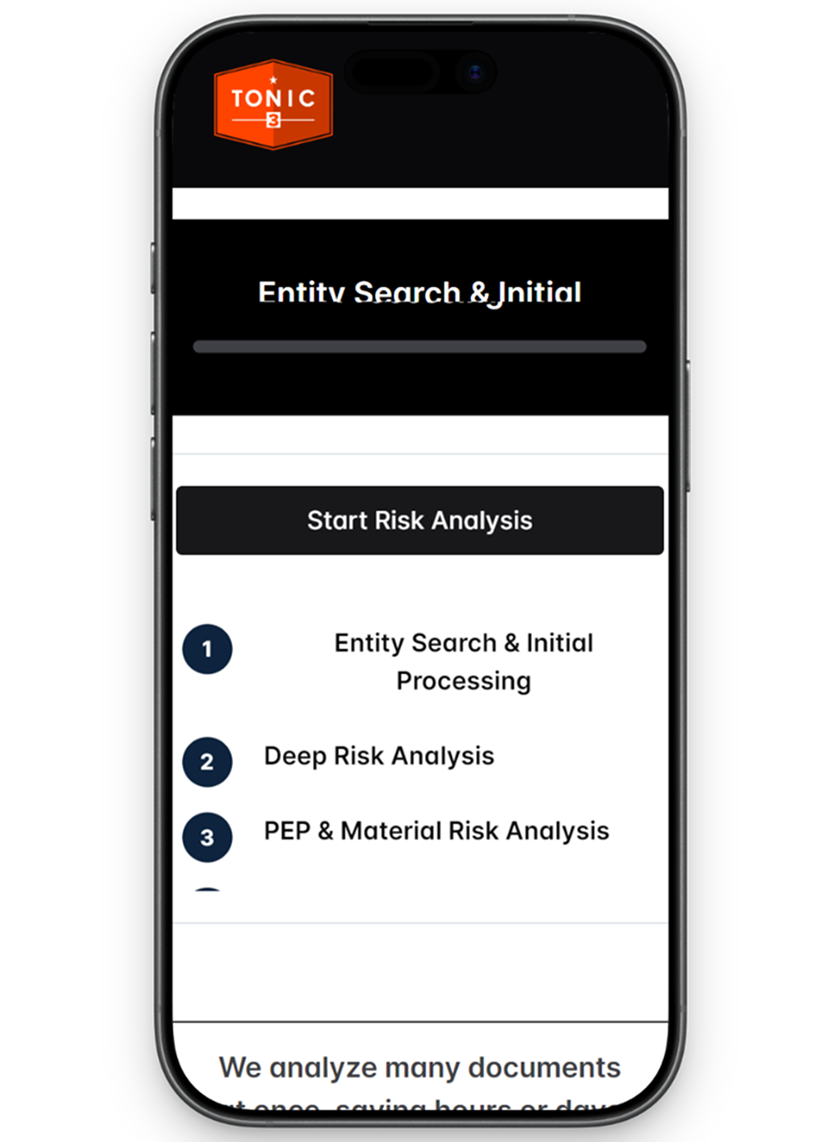

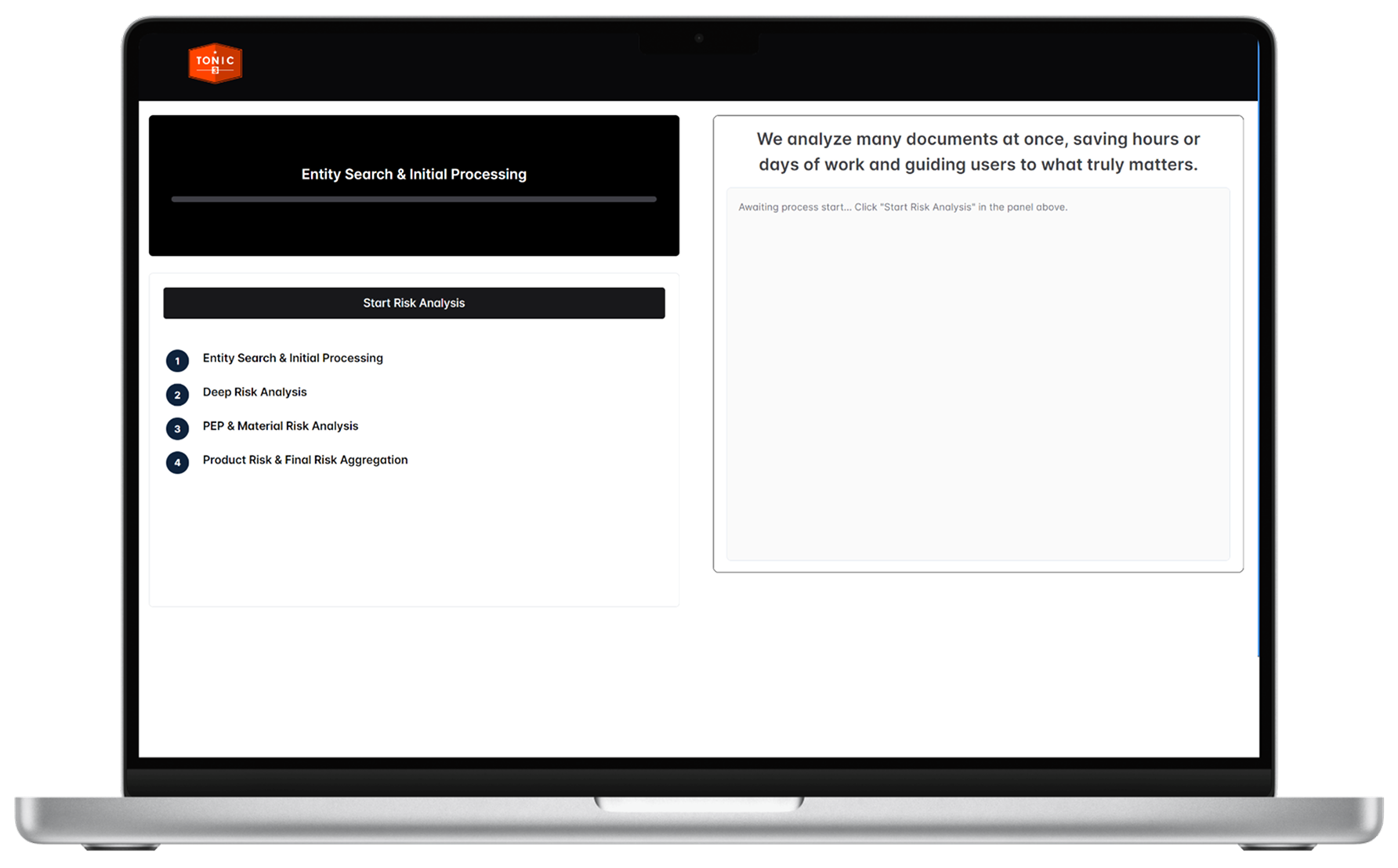

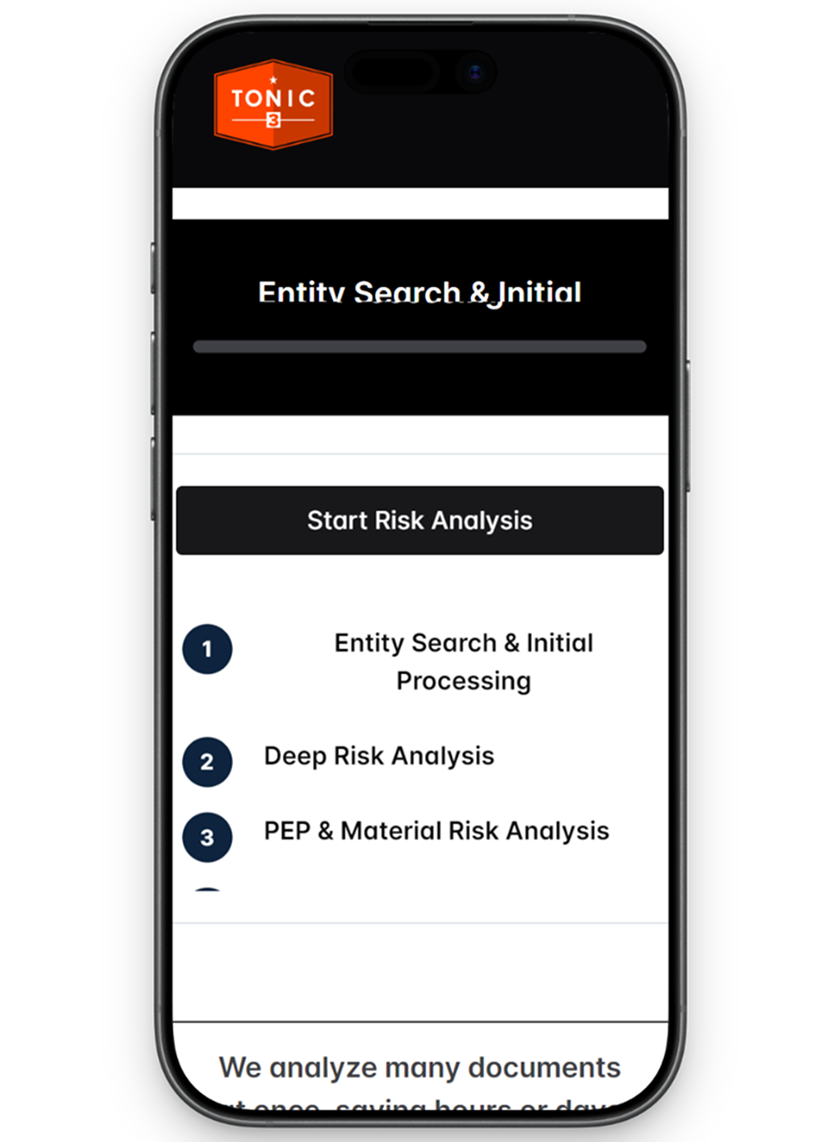

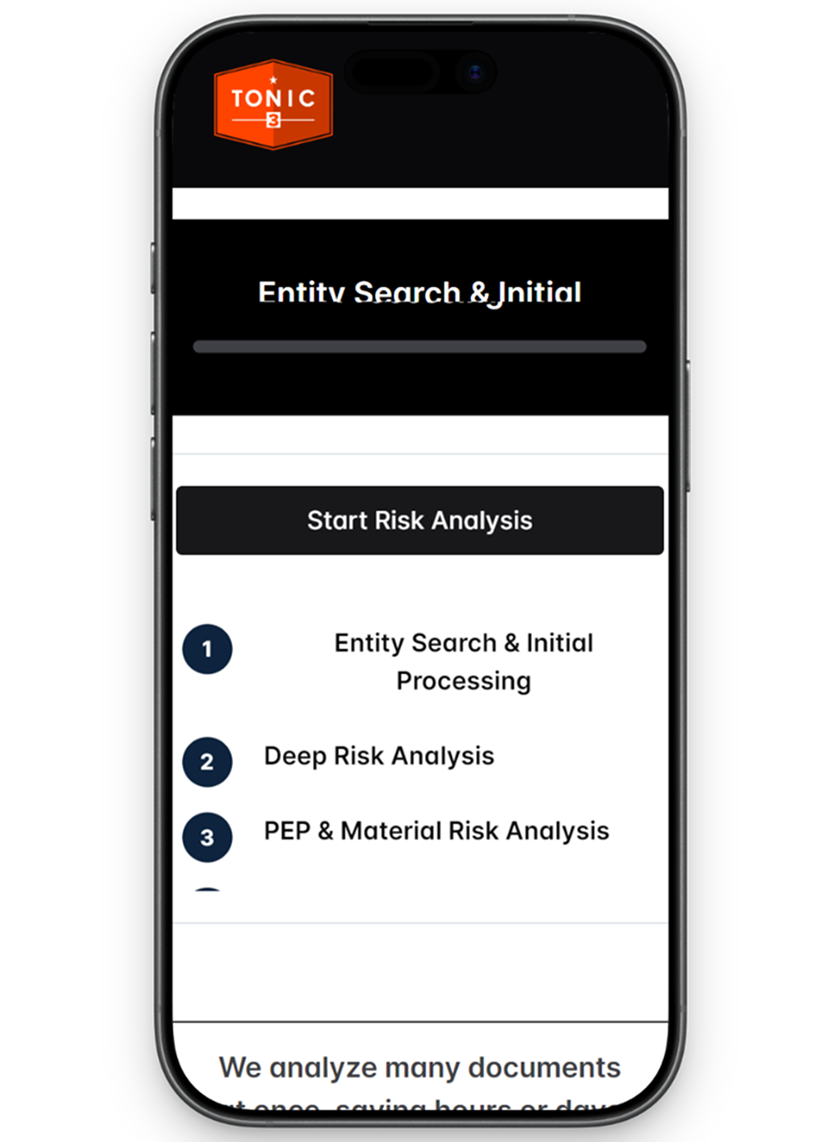

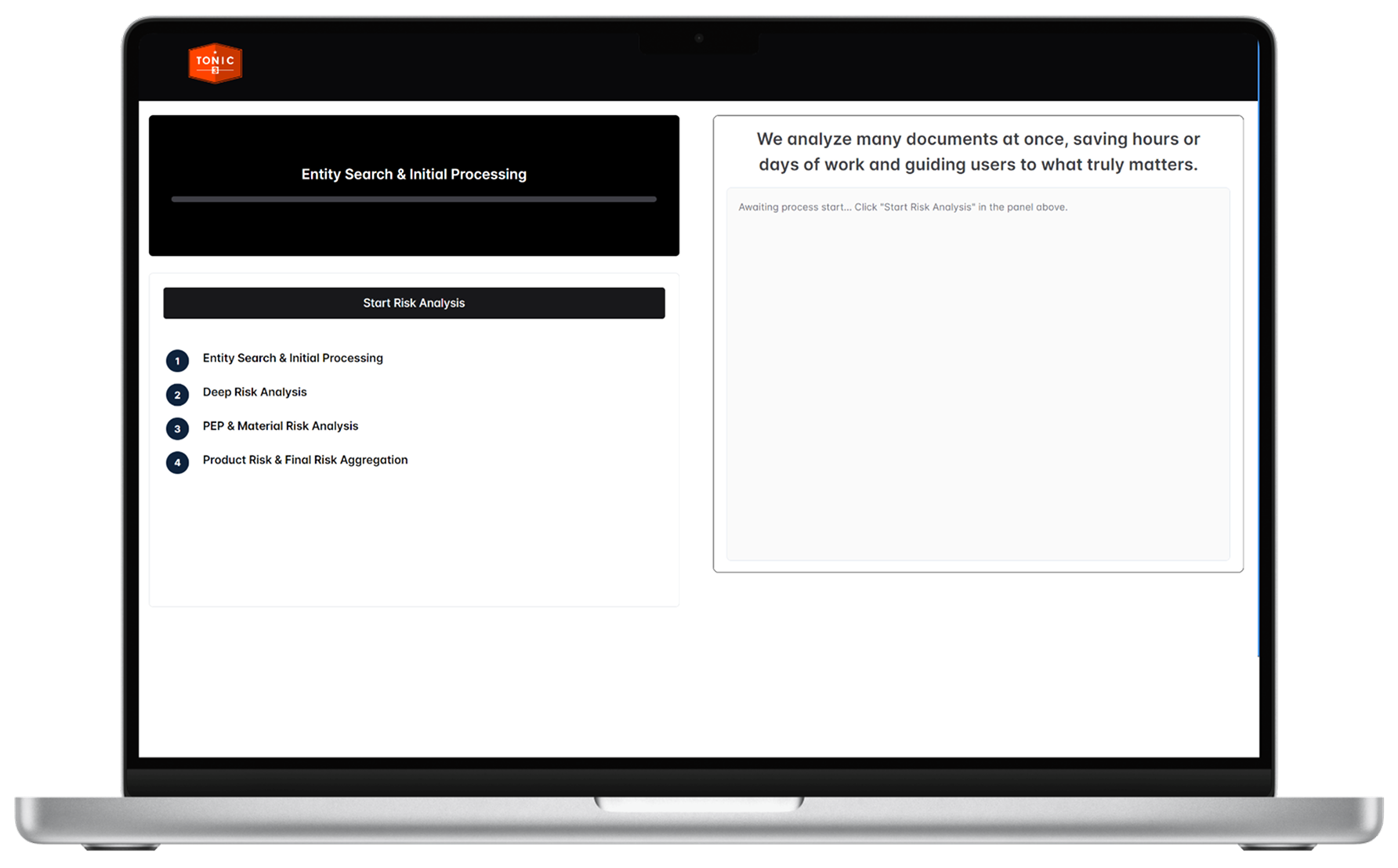

Human-Centered UX: Simplifying Clarity for Risk Teams

The solution was designed to consolidate diverse risk data into a single, comprehensive dashboard. This focus on clarity and usability ensured the risk teams could quickly interpret complex results and act with confidence, minimizing human error and driving a Human Performance Advantage.

Custom-Built Code: Building the Right Foundation for Trust

We engineered a secure, Custom-Built Code back-end that integrated verified data sources for entity verification and jurisdictional risk analysis. This engineering rigor ensured the risk model is reliable, auditable, and adheres to strict banking-grade standards, demonstrating Driving Velocity & Rigor.

AI Governance & Strategy: Empowering Decisions with Intelligence

The core utilized an AI-Powered Solution to process raw data and deliver a comprehensive risk rating and structured report. The team ensured the AI Governance framework was embedded from day one, giving the organization the necessary control and transparency required for regulatory compliance.

The Impact: Strategic Performance & A Sustained Confidence

The partnership resulted in a significant uplift in Operational Clarity around risk. By automating the assessment of risk factors and delivering structured reports, we helped the bank move from manual consolidation to strategic decision-making. This secured the compliance process, directly assisting the goal of protecting Cash Flow and reinforcing confidence in financial operations.

Human-Centered UX: Simplifying Clarity for Risk Teams

The solution was designed to consolidate diverse risk data into a single, comprehensive dashboard. This focus on clarity and usability ensured the risk teams could quickly interpret complex results and act with confidence, minimizing human error and driving a Human Performance Advantage.

Custom-Built Code: Building the Right Foundation for Trust

We engineered a secure, Custom-Built Code back-end that integrated verified data sources for entity verification and jurisdictional risk analysis. This engineering rigor ensured the risk model is reliable, auditable, and adheres to strict banking-grade standards, demonstrating Driving Velocity & Rigor.

AI Governance & Strategy: Empowering Decisions with Intelligence

The core utilized an AI-Powered Solution to process raw data and deliver a comprehensive risk rating and structured report. The team ensured the AI Governance framework was embedded from day one, giving the organization the necessary control and transparency required for regulatory compliance.

The Impact: Strategic Performance & A Sustained Confidence

The partnership resulted in a significant uplift in Operational Clarity around risk. By automating the assessment of risk factors and delivering structured reports, we helped the bank move from manual consolidation to strategic decision-making. This secured the compliance process, directly assisting the goal of protecting Cash Flow and reinforcing confidence in financial operations.

Outcomes + Why It Matters (Q&A for Change Champions)

-

How did the platform directly help protect Cash Flow (CFO)?

By automating and streamlining the compliance process, the solution minimized the risk of costly regulatory fines and liabilities, directly safeguarding the organization's financial stability and Cash Flow.

-

How did Tonic3’s blended skillset ensure we were a trustworthy partner?

We embedded AI Governance & Strategy into the Custom-Built Code, ensuring the solution was not only intelligent but also secure, auditable, and compliant with banking regulations from day one.

-

How does this foundation prepare the client for future risk management?

The structured data output and established AI governance framework create a modular, scalable foundation for implementing more complex, enterprise-wide risk management workflows.